The Westchester-Putnam Workforce Development Board (WPWDB) kicked off the “Volunteer Income Tax Assistance” (VITA) Program on Feb. 22, 2021. Customers must make an appointment by calling 211 or (800) 899-1479 to schedule a drop-off time at one of two locations. Also available are the self-service websites MyFreeTaxes.com.

Once an appointment is made, tax filers will drop off their documents at Mount Vernon Career Center or Ossining High School.

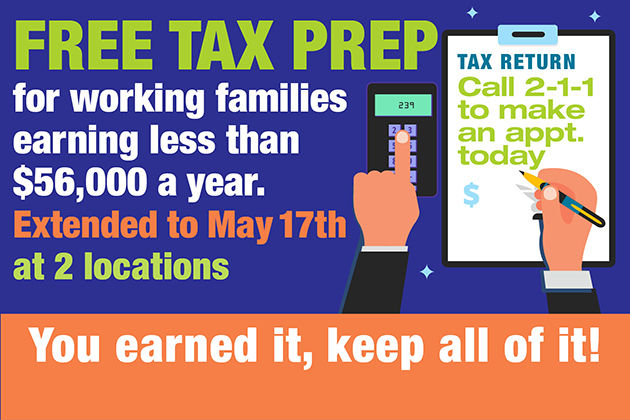

The VITA program, which was originally scheduled to run February 22 to April 15th has been extended to May 17, 2021. It helps low- and moderate-income individuals and families eligible for the federal Earned Income Tax Credit (EITC) file their taxes for free, including people with disabilities, senior citizens, and those for whom English is a second language. To make sure the program delivers maximum benefits, VITA relies on dedicated volunteers to act as greeters, and assist with translation and call-center operations. Tax preparation is done by IRS-certified volunteers with FREE electronic filing.

Westchester County Executive George Latimer stated, “Even in the midst of a pandemic we are committed to helping our residents take advantage of all the tax credits for which they are eligible. The VITA program not only assists working families and individuals, but also increases tax dollars in the County. It is estimated that about 80% of refunds are then spent locally, which generates local sales, wages and jobs, ultimately boosting the local economy.”

The program is delivered through a collaboration of partners who work diligently to coordinate the day-to-day appointments and operations—United Way 2-1-1, Volunteer NY, WestCOP, AARP, the IRS, Westchester County Government, Westchester Community College, Westchester Education Opportunity Center, Mercy College Westchester and Bronx Campus, Interfaith Council Association, The Yonkers Public Library, Childcare Council of Westchester, SW BOCES, Community Capital NY, Ossining High School, Westchester Library System, and the Westchester-Putnam Career Center Network.

The program is designed to provide eligible Westchester County residents with free tax prep assistance to maximize their tax refund and help those who are eligible take advantage of the federal Earned Income Tax Credit (EITC), a federal tax credit designed to help low income taxpayers making less than $56,000 a year. Many eligible Westchester residents are not aware of the credit and therefore do not claim it. Maximum credits depend on income, marital status and number of dependents. It is estimated that about 80% of refunds are spent locally, which generates local sales, wages and jobs, ultimately boosting the local economy.

Call 211 or (800) 899-1479 to make an appointment.

Media materials: printer-friendly release and flier:

VITA Tax Prep 2021 Flier (revised)

Printer-friendly version of article (revised)