The Westchester-Putnam Workforce Development Board (WPWDB) is looking for people of all professional backgrounds and experience levels to help administer its popular Volunteer Income Tax Assistance (VITA) Program. The program, which will run from Feb. 15 - April 30, 2021, will help low- and moderate-income individuals and families eligible for the federal Earned Income Tax Credit (EITC) file their taxes and maximize their returns.

The Westchester-Putnam Workforce Development Board (WPWDB) is looking for people of all professional backgrounds and experience levels to help administer its popular Volunteer Income Tax Assistance (VITA) Program. The program, which will run from Feb. 15 - April 30, 2021, will help low- and moderate-income individuals and families eligible for the federal Earned Income Tax Credit (EITC) file their taxes and maximize their returns.

To make sure all funding directly benefits tax filers, VITA relies on dedicated volunteers to assist with various tasks, including tax preparation, translation, call-center operations, and acting as greeters. No previous experience is required, and IRS-sponsored training will be provided which will take place virtually online (see schedule below). Work schedules are flexible, averaging a three to four hour per week commitment. Due to COVID, the tax prep program will be delivered remotely using virtual online technology. All volunteers must have access to a computer and wifi in order to assist tax filers, no matter what their volunteer role is.

Since its inception, VITA has been a vital free service for those living paycheck to paycheck or with fixed incomes. On top of EITC savings, which can provide as much as $6,318, clients often discover that they are eligible for additional credits such as the Credit for the Elderly or Disabled.

“Many taxpayers who come to the VITA site would otherwise turn to paid tax preparers who charge significant fees,” said Victor Avendano, Program Specialist for Westchester-Putnam Career Center Network. "By using VITA, those taxpayers have more money to use for paying bills, making home repairs and saving for the future.”

Training and certification for volunteer tax preparers are offered free and are sponsored by the Internal Revenue Service. Individuals who complete the tax prep training and pass the tax prep test will be certified volunteer tax preparers.

All Interested in volunteering are asked to register.

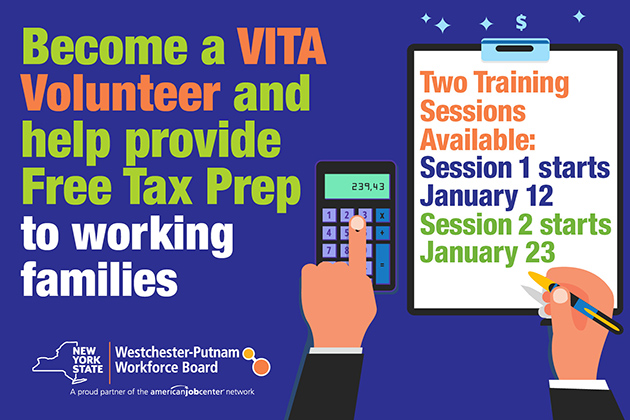

Two training seesions are available

All sessions will be held online by computer. Each session includes the dates listed below it.

Session 1:

Tues., Jan. 12, 5 – 8 p.m.

Thurs., Jan. 14, 5 – 8 p.m.

Sat. Jan. 16, 9 a.m. – noon

Tues., Jan. 19, 5 – 8 p.m.

Thurs., Jan. 21, 5 – 8 p.m.

Sat., Jan. 23, 9 a.m. – noon

Session 2:

Tues., Jan. 26, 5 – 8 p.m.

Thurs., Jan., 28, 5 – 8 p.m.

Sat., Jan. 30, 9 a.m. – noon

Tues., Feb. 2, 5–8 p.m.

Thurs. Feb. 4, 5– 8 p.m.

Sat., Feb. 6, 9 a.m. – noon

For more information about the process for becoming a VITA volunteer, contact Victor Avendano at (914) 995-3924 or e-mail on vaa3@westchestergov.com.

Media materials: printer-friendly release and flier:

VITA Volunteer Tax Prep 2021 Flier

Printer friendly version of article