The Westchester-Putnam Workforce Development Board (WPWDB) is looking for people of all professional backgrounds and experience levels to help administer its popular Volunteer Income Tax Assistance (VITA) Program. The program, which will run from Feb. 1 to April 15, 2018, will help low and moderate income individuals and families eligible for the federal Earned Income Tax Credit (EITC) file their taxes and maximize their returns.

The Westchester-Putnam Workforce Development Board (WPWDB) is looking for people of all professional backgrounds and experience levels to help administer its popular Volunteer Income Tax Assistance (VITA) Program. The program, which will run from Feb. 1 to April 15, 2018, will help low and moderate income individuals and families eligible for the federal Earned Income Tax Credit (EITC) file their taxes and maximize their returns.

Since its inception, VITA has been a vital free service for those living paycheck to paycheck or with fixed incomes. On top of EITC savings, which can provide as much as $6,318, clients often discover that they are eligible for additional credits such as the Credit for the Elderly or Disabled.

“Many taxpayers who come to the VITA site would otherwise turn to paid tax preparers who charge significant fees,” said Victor Avendano, Program Specialist for Westchester-Putnam One Stop Career Center. By using VITA, those taxpayers have more money to use for paying bills, making home repairs and saving for the future.”

To make sure all funding directly benefits tax filers, VITA relies on dedicated volunteers to assist with various tasks, including tax preparation, translation, call-center operations and acting as greeters. Help is needed at sites in Dobbs Ferry, Mount Vernon, Valhalla, White Plains and Yonkers. No previous experience is required, and IRS-sponsored training will be provided. Work schedules are also flexible, averaging a three to four hour per week commitment.

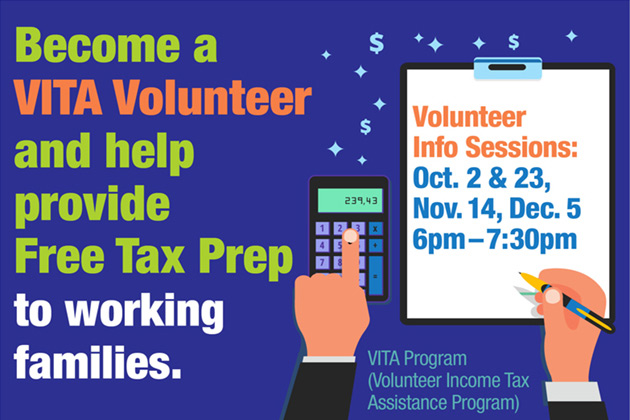

Volunteer Information and Training Sessions

Those who are considering becoming a volunteer are invited to attend one of four information sessions. All sessions below are held on a Tuesday.

Oct. 2, 2018, White Plains Career Center, 120 Bloomingdale Road, NY, 6 – 7:30 p.m.

Oct. 23, 2018, White Plains Career Center, 120 Bloomingdale Road, NY, 6 – 7:30 p.m.

Nov. 14, 2018, White Plains Career Center, 120 Bloomingdale Road, NY, 6 – 7:30 p.m.

Dec. 5, 2018, Mount Vernon Career Center, 130 Mount Vernon Place, Mount Vernon, NY, 6 – 7:30 p.m.

For more information about the process for becoming a VITA volunteer, contact Victor Avendano by phone at (914) 995-3924 or by e-mail at vaa3@westchestergov.com.

You may also register online.

Volunteer Job Descriptions and Training Requirements

Tax Preparers: Tax Preparers assist low income wage earners in completing their tax returns and discuss asset development programs available at the site.

Training Needed: Tax Preparers receive training and are certified by the IRS. Self-study through IRS’s Ling and Learn site and classroom training/practice session will be provided, and a passing score of 80% on each certification exam is required. Certification levels are Basic, Intermediate, and Advance. A Preparer must take each level of instruction and exam before moving to the next level, and can only prepare returns that are within the scope of his certification. For example, a taxpayer who has itemized deductions needs to have the return arranged by a preparer with an Intermediate or above certification.

Quality Reviewers: Quality Reviewers follow a check list to ensure the accuracy of prepared returns.

Training Needed: Same training and certification as required for Tax Preparers, as well as additional quality reviewer training. Reviewers must certify, at a minimum, through the Intermediate level.

Greeters: Greeters welcome tax filers to the VITA site during the tax season. They are responsible for ensuring that tax filers have all the information needed to complete their tax returns and will assist taxpayers with available financial education and asset development materials.

Training Needed: No training required, but greeters will receive an orientation to the site and materials to be distributed.