Jan. 24, 2019 — The Westchester-Putnam Workforce Development Board (WPWDB) will host an IRS endorsed “Volunteer Income Tax Assistance” (VITA) Program Kickoff event on Friday, Feb. 1, at 11:45 a.m. at 130 Mount Vernon Avenue, Mount Vernon, NY.

Jan. 24, 2019 — The Westchester-Putnam Workforce Development Board (WPWDB) will host an IRS endorsed “Volunteer Income Tax Assistance” (VITA) Program Kickoff event on Friday, Feb. 1, at 11:45 a.m. at 130 Mount Vernon Avenue, Mount Vernon, NY.

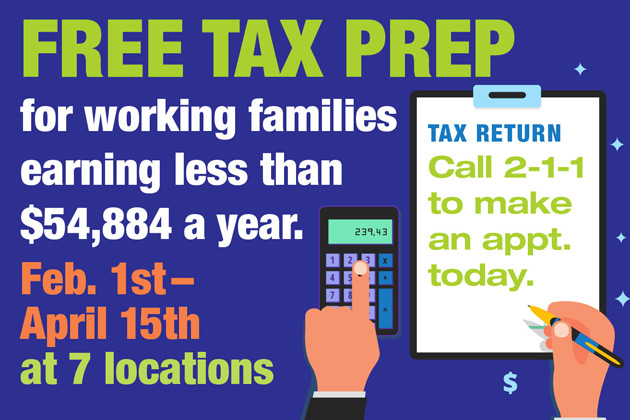

The kickoff launches an educational campaign to increase awareness to eligible Westchester County residents about the free tax prep assistance available, and the qualifications to receive federal tax credits designed to help low income taxpayers making less than $54,884 a year.

The VITA program, which will run Feb. 1 to April 15 at seven locations (see below), helps low- and moderate-income individuals and families eligible for the federal Earned Income Tax Credit (EITC) file their taxes and maximize their returns. To make sure the program delivers maximum benefits, VITA relies on dedicated volunteers to act as greeters, assist with translation and call-center operations. Tax preparation is done by IRS-certified volunteers.

Westchester County Executive George Latimer said: “We are committed to helping our residents take advantage of all the tax credits for which they are eligible. The VITA program not only assists working families and individuals, but also increases tax dollars in the County. It is estimated that about 80 percent of refunds are then spent locally, which generates local sales, wages and jobs, ultimately boosting the local economy.”

Call 211 or (800) 899-1479 to make an appointment, or visit one of seven locations listed on the flier. (Lea le volante en español.)

The Earned Income Tax Credit (EITC) is a federal tax credit available to working families and individuals with modest incomes. Many eligible Westchester residents are not aware of the credit and therefore do not claim it. Maximum credits depend on income, marital status and number of dependents. Each year New York State sets threshold limits at the beginning of the tax preparation season (see below for 2018 limits).

VITA Free Tax Prep Program Runs from Feb.1 through April 15

Volunteer tax preparer and Spanish translator assistance runs from February 1 through April 15 and is available at the sites below. The last appointment dates are listed by each location. Call 211 or (800) 899-1479 to make an appointment at one of the Westchester County VITA/EITC Tax Assistance locations.

Free Tax Prep Locations

White Plains

White Plains Career Center, 120 Bloomingdale Road, 2nd Floor

Feb. 2 – April 13, 2019.

Tuesday and Thursday: 11 a.m. – 7 p.m.

Saturday: 9 a.m. – 1 p.m.

Languages: English, Spanish

Last Day: April 13 | last open appointment noon

Dobbs Ferry

Mercy College, 555 Broadway, Victory Hall, Room 100 (formerly Our Lady of Victory HS)

Saturdays: February 2 to March 23, April 6 and April 13, 2019

Hours: 9:30 a.m. – 3 p.m.

Note: Site not in operation March 30

Sundays: Feb. 17, Feb. 24, March 3, March 10 and March 17

Hours: 9:30 a.m. – 1 p.m.

Languages: English

Last Day: March 17 | last open appointment noon

Mount Vernon

Mount Vernon Career Center, 130 Mount Vernon Avenue

Feb.1 – April 12, 2019

Wednesday and Friday: 9 a.m.– 5 p.m.

Languages: English

Last Day: April 12 | last open appointment 4 p.m.

Valhalla

Westchester Community College Gateway Center, 75 Grassland Road, Gateway Building across from parking lot #1.

Feb. 4 – April 15, 2019

Mondays and Wednesdays: 10 a.m.– 5 p.m.

Languages: English, Spanish

Note: Walk-ins are for WCC students only

Last Day: April 15 | last open appointment 4 p.m.

Yonkers

SUNY Westchester Educational Opportunity Center, 26 South Broadway

Feb/ 5 – April 11, 2019

Tuesdays and Thursdays: Noon – 8 p.m.

Winter Break Dates: Feb. 19 and 21: Noon – 5 p.m.

Languages: English, Spanish

Bronx

Mercy College Bronx Campus, 1200 Waters Place, 1st Floor, Room 1344

Fridays: 2/1, 2/8, 2/22, 3/1, 3/15, 3/22, 4/5 and 4/12

Hours: 11 a.m. – 5 p.m.

Note: Site is not in operation Feb.15 or March 29

Languages: English, Spanish

Last Day: April 12 | last open appointment 4 p.m.

Ossining:

IFCA Housing Network, 138 Spring Street, Ossining, NY 10562

Dates and Times: Feb. 4 to April 15 | Appointment. only

Monday: Noon – 3 p.m.

Tuesday: 10 a.m. – 3 p.m.

Wednesday: 1 – 5 p.m.

Thursday: 10 a.m. – 3 p.m.

Friday: 1:30 – 3:30 p.m.

Saturday: 12 – 3 p.m.

Last Day: April 15 | last open appointment 2 p.m.

Ossining High School

Monday: 4 p.m. –7 p.m. (walk-ins)

Who Qualifies for EITC?

The potential maximum tax credit includes federal, state and New York City credits and depends on income, marital status and number of qualifying children in the household. Qualifying children can be a son, daughter, grandchild, adopted child, step child or foster child as long as the child is under 19 years of age, under the age of 24 if a full-time student, or be permanently and totally disabled at any time during the year. The child must have the same principal residence as the taxpayer for more than half the tax year and not provide more than one-half of his/her own support for the year.

Single (ages 25-65)

With no children: Maximum income to be eligible: $15,270; Maximum tax credit: $519

With one child: Maximum income to be eligible: $40,320; Maximum tax credit: $3,461

With two children: Maximum income to be eligible: $45,802; Maximum tax credit: $5,716

With three or more children: Maximum income to be eligible: $49,194; Maximum tax credit: $6,431

Married/filing jointly (ages 25-65)

With no children: Maximum income to be eligible: $20,950; Maximum tax credit: $519

With one child: Maximum income to be eligible: $46,010; Maximum tax credit: $3,461

With two children: Maximum income to be eligible: $51,492; Maximum tax credit: $5,716

With three or more children: Maximum income to be eligible: $54,884; Maximum tax credit: $6,431

_______________

Media materials: printer-friendly release, and image/video assets:

Printer friendly version of article

Media contact

Risa B. Hoag

(845) 627-3000

risabh@gmail.com