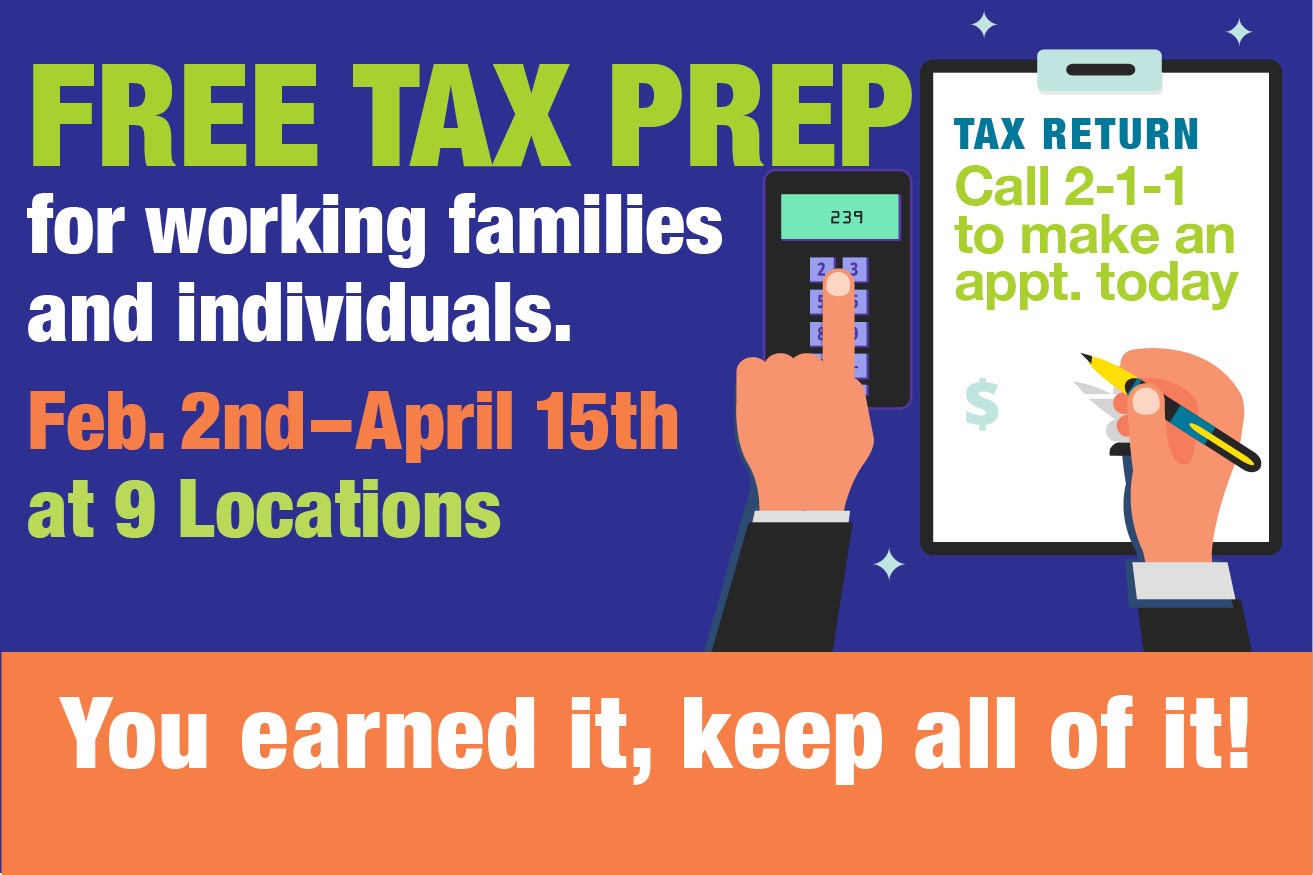

(WESTCHESTER) February 23, 2024—The Westchester-Putnam Workforce Development Board’s (WPWDB) “Volunteer Income Tax Assistance” (VITA) Program is available at select locations throughout Westchester and the Bronx through Monday, April 15. Residents can call 211 or 1-800-899-1479 to schedule an appointment at one of nine locations listed below.

The VITA program helps low- and moderate-income individuals and families eligible for the Federal Earned Income Tax Credit (EITC) file their taxes for free, including people with disabilities, senior citizens, and those for whom English is a second language. To make sure the program delivers maximum benefits, VITA relies on dedicated volunteers to act as greeters, and assist with translation and call-center operations. Tax preparation is done by IRS-certified volunteers with FREE electronic filing.

Westchester County Executive George Latimer stated, “What started as a small program in 1969, to help the IRS increase taxpayer education, has evolved into a critical resource for low- and moderate-income taxpayers. Today, the VITA program ensures accurate tax returns, equitable access to the tax code, and needed tax refunds for our working families and individuals who most need them. It also serves to boost the local economy; it’s estimated that about 80% of refunds are spent locally, generating sales, wages, and jobs.”

Yonkers Mayor Mike Spano said: “We are proud to provide our hard-working residents access to free tax prep services they can trust and rely on right in their local community. We’re especially pleased that VITA services will be offered for the first time at the WCC Campus at the Cross County Shopping Center. We thank all the IRS certified volunteers for their time and talent.”

The program is delivered through a collaboration of partners who worked diligently to coordinate the day-to-day operations—2-1-1 Hudson Valley/United Way of Westchester and Putnam; the IRS; Westchester County Government; Westchester Community College, Valhalla and Cross County Campuses; Mercy University, Dobbs Ferry and Bronx Campuses; Ossining High School; Ossining Youth Bureau; Westchester Jewish Community Services; and the Westchester-Putnam Career Center Network.

Call 211 or 1-800-899-1479 to make an appointment at one of the nine locations listed.

VITA Free Tax Prep Program Runs from February 2 through April 15

Volunteer tax preparer and language translator assistance runs from February 2 through April 15 and is available at the sites below. Call 211 or (800) 899-1479 to make an appointment at one of the Westchester County VITA/EITC Tax Assistance locations.

Free Tax Prep Locations

White Plains Career Center, 120 Bloomingdale Road, 2nd Floor, White Plains, NY 10605

Note: Entrance at rear of the building.

Dates/Times: February 12 to April 15 | Mondays: 4 pm –8 pm

Saturdays, beginning February 17, ending April 13: 10:00 am–4:00 pm

- By appointment only.

- Language translation available.

- Reasonable Accommodations will be provided, upon request.

Mercy University—Dobbs Ferry Campus

555 Broadway, Victory Hall, Room 100, Dobbs Ferry, NY 10552

Note: The entrance to Victory Hall, Room 100 is the second entrance after Mercy’s main entrance on Broadway. Park in the Lot.

Dates/Times: Saturdays: February 3 to April 13 | 9:30 am–3:30 pm

Last Day: April 13

- Language translation available.

- Appointments and walk-ins welcomed.

- Reasonable accommodations will be provided, upon request.

Mercy University - Bronx Campus

1200 Waters Place (1st Floor, Room 1380), Bronx, NY 10461

Dates/Times: Fridays: February 2 to April 12 | 11:30 am–5:30 pm

Last Day: April 12

- Language translation available.

- Appointments and walk-ins welcomed.

- Reasonable accommodations will be provided, upon request.

Mount Vernon Career Center

130 Mount Vernon Avenue, Mount Vernon, NY 10550

Note: Entrance on Macquesten Parkway. Parking is available in lot on Mt. Vernon Ave.

Dates/Times: Fridays, starting February 16 to April 12 | 10:00 am–4:00 pm

Saturdays, starting February 17 to April 13: 9 am–3 pm

Last Day: April 13

- By appointment only.

- Language translation available.

- Reasonable accommodations will be provided, upon request.

Ossining Youth Bureau

Joseph G. Caputo Community Center, 95 Broadway, Ossining, NY 10562

Dates/Times: Saturdays, starting February 17 to April 13 | 10:00 am–4:00 pm

Last Day: April 13

- By appointment only.

- Language translation available.

- Reasonable accommodations will be provided, upon request.

Ossining High School

29 South Highland Avenue, Ossining, NY 10562

Dates/Times: February 12 to April 15

Mondays: 3:30 pm–8 pm |

Last Day: April 15

- By appointment only.

- Language translation available.

- Reasonable accommodations will be provided, upon request.

Westchester Community College (Gateway Center, Valhalla Campus)

75 Grasslands Road, Room G144, Valhalla, NY 10595

Note: Entrance is across from parking lot 1.

Dates/Times: February 12 to April 15

Mon. & Wed.: 9 am–4 pm

Last Day: April 15

- By appointment only.

- Language translation available.

- Reasonable accommodations will be provided, upon request.

Westchester Community College (Cross County Campus)

843 Kimball Avenue (Learning Commons),

Yonkers, NY 10704

Dates/Times: Saturdays, starting February 17 to April 13 | 1:00 pm–4:00 pm

Last Day: April 13

- By appointment only.

- Language translation available.

- Reasonable accommodations will be provided, upon request.

Westchester Jewish Community Services – Hartsdale

141 North Central Avenue, Hartsdale, NY 10530

Note: Parking/Entrance is in the rear. The Verizon Store is an outstanding marker that you have arrived at the correct shopping center. It is the shopping center before the Trader Joe’s.

Dates/Times: Tuesdays and Thursdays, starting February 13 to April 11 | 5:00 pm–7:00 pm

Last Day: April 11

- By appointment only.

- Language translation available.

- Reasonable accommodations will be provided, upon request.

Who Qualifies for EITC?

The potential maximum tax credit includes federal, state and New York City credits and depends on income, marital status and number of qualifying children in the household. Qualifying children can be a son, daughter, grandchild, adopted child, step child or foster child as long as the child is under 19 years of age, under the age of 24 if a full-time student, or be permanently and totally disabled at any time during the year. The child must have the same principal residence as the taxpayer for more than half the tax year and not provide more than one-half of his/her own support for the year.

The Volunteer Income Tax Assistance (VITA) Free Tax Prep program is a national initiative sponsored by the IRS and the state Office of Temporary and Disability Assistance to help low- and moderate-income residents qualify for federal and state earned income tax credits (EITC).